Are you trying to figure out how to endorse Discover Bank Mobile Deposit? With the world becoming increasingly digital, it’s not surprising that more and more people are taking advantage of the convenience of mobile banking. But the process of endorsing a check for mobile deposit can be a bit confusing, especially if you’re new to the process. Fear not, we’re here to explain it all and help you get your deposits processed quicker and easier. Keep reading to learn how to endorse Discover Bank Mobile Deposit.

Endorsing a Discover Bank Mobile Deposit

Endorsing a Discover Bank Mobile Deposit is easy and convenient. Here’s how:

- Log in to the Discover Bank Mobile App.

- Select the account you wish to make a mobile deposit to.

- Choose the amount of the check you’re endorsing.

- Take a photo of the check with your phone.

- Confirm the details of the check.

- Enter the check endorsement information.

- Submit the deposit.

Once the deposit is accepted, the funds will be available in your account.

How to Use Discover Bank Mobile Deposit

Discover Bank Mobile Deposit is a convenient way for customers to deposit checks without making a trip to the bank. It is easy to use, secure, and can save you time and money. In this article, we will discuss how to endorse Discover Bank Mobile Deposit and the benefits it provides.

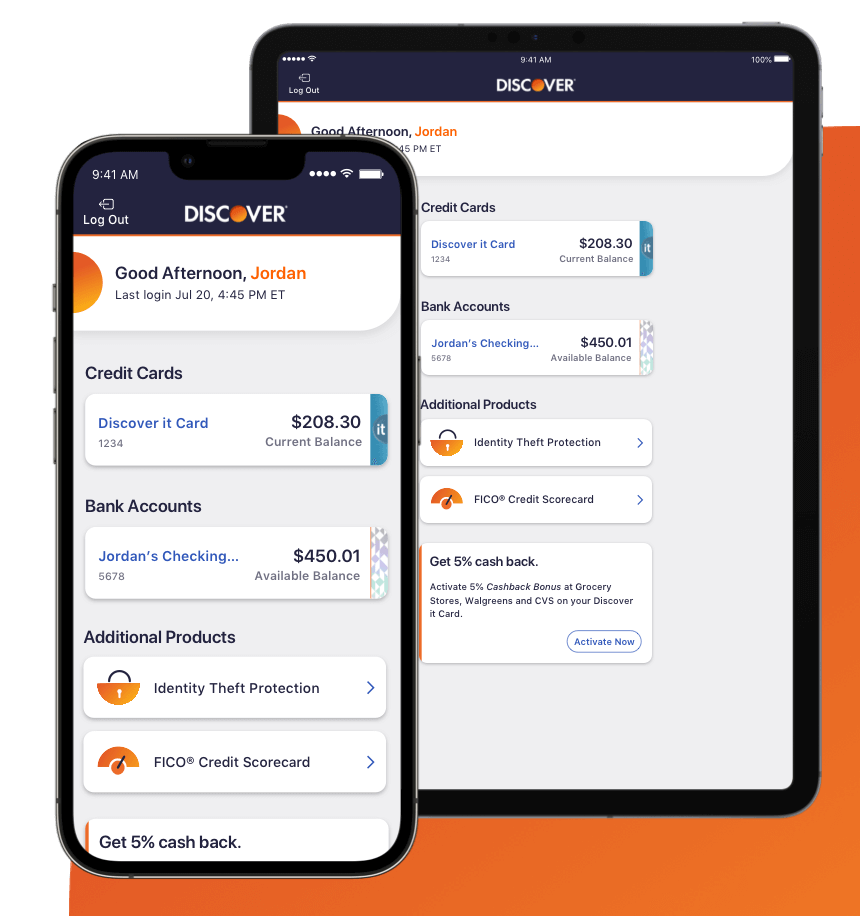

The first step in endorsing Discover Bank Mobile Deposit is to make sure you have a Discover Bank account. Once you have an account, you can access the mobile deposit feature through the Discover Bank app. You will need to enter your login information and verify your identity before you can start depositing checks.

Once you are logged in, you will be able to view your account information and deposit checks. To deposit a check, you will need to enter the amount of the check, select the account you want to deposit the check into, and take a picture of the front and back of the check. Once you have done this, you will need to endorse the check.

Endorsement Requirements for Discover Bank Mobile Deposit

When you endorse a check for Discover Bank Mobile Deposit, you must sign the back of the check and write “For Mobile Deposit Only at Discover Bank” underneath your signature. This endorsement ensures that the check is deposited into the correct account and prevents fraud.

You must also make sure that you write the account number you are depositing the check into on the back of the check. This helps to ensure that the check is deposited into the correct account.

Benefits of Using Discover Bank Mobile Deposit

Using Discover Bank Mobile Deposit has a number of benefits. It is a secure and convenient way to deposit checks, and it can save you time and money by eliminating the need to make a trip to the bank.

It is also a great way to keep track of your deposits. You can view your deposit history on the Discover Bank app and make sure that your checks have been deposited into the correct account.

Limitations of Using Discover Bank Mobile Deposit

While Discover Bank Mobile Deposit is a great way to deposit checks, there are some limitations. For example, you can only deposit checks with a maximum amount of $2,500. Also, the check must be payable to you and not a third party.

How to Keep Your Account Secure

When using Discover Bank Mobile Deposit, it is important to keep your account secure. Make sure you use a secure password and do not share it with anyone. You should also regularly change your password to ensure that your account is secure.

Tips for Using Discover Bank Mobile Deposit

When using Discover Bank Mobile Deposit, there are a few tips that can help you get the most out of the service. Make sure you enter the correct account information and amount when depositing a check. Also, be sure to endorse the check correctly and include your account number. Finally, keep your account secure by using a secure password and changing it regularly.

Frequently Asked Questions

What is Discover Bank Mobile Deposit?

Discover Bank Mobile Deposit is an online banking feature offered by Discover Bank that allows customers to securely deposit checks into their accounts from their mobile devices. Customers can deposit checks from anywhere at any time, quickly and easily. It’s a convenient and secure way to manage your finances.

What types of checks can I deposit with Discover Bank Mobile Deposit?

You can deposit personal, business, and government checks with Discover Bank Mobile Deposit. It is important to note that foreign checks and traveler’s checks are not eligible for deposit via the Discover Bank Mobile Deposit service.

What information do I need to endorse a check for Mobile Deposit?

When endorsing a check for Mobile Deposit, you must include your signature, account number, and the words “For Mobile Deposit Only at Discover Bank”. This information must be written on the back of the check in the endorsement area.

What is the process for making a Mobile Deposit?

The process for making a Mobile Deposit is simple. First, log into your Discover Bank account and select the Mobile Deposit option. Then, take a picture of the front and back of the endorsed check. Finally, submit the check for deposit and wait for it to be approved. You will receive a confirmation email once the deposit has been approved.

Are there any fees associated with Mobile Deposit?

No, Discover Bank does not charge a fee for using the Mobile Deposit service. However, you may be subject to fees from your mobile carrier.

What is the processing time for Mobile Deposits?

Mobile deposits are generally processed within one business day after the day you submit the deposit. After the deposit has been approved, the money will be available in your account.

Discover Bank Mobile Deposit is an easy and secure way to deposit funds into your account. With fast and intuitive technology, you can quickly access your funds, and know that your money is safe and secure. It’s a great way to make sure your money is always accessible and secure, no matter where you are. So if you’re looking for a convenient and reliable way to deposit funds, Discover Bank Mobile Deposit is the right choice for you. Take advantage of this great service today and enjoy the peace of mind that comes with knowing your money is always safe.